OUR BLOGS

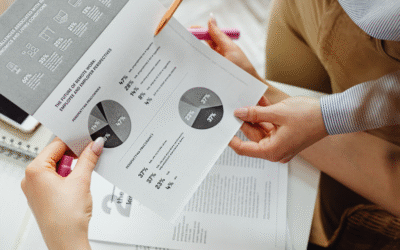

How Tax Planning Can Save Your Business Thousands

A Practical Guide for Canadian Business Owners Running a business in Canada involves more than just delivering excellent products or services. Smart financial management is essential to long-term success, and at the heart of that is effective tax planning. Yet, many...

Real Estate and Capital Gains Tax and What You Should Know

Real estate has long been a popular investment avenue in Canada, offering both stability and the potential for substantial appreciation. However, when it comes time to sell a property, investors and homeowners alike must consider the implications of capital gains tax....

How Payroll Errors Can Cost Your Business—and How to Prevent Them

In the modern business landscape, payroll is more than just an administrative task—it is a vital function that directly impacts employee morale, legal compliance, and financial stability. When payroll is managed efficiently, it fosters trust and operational...

The Role of an Accountant in Business Planning and Growth

In today’s competitive and rapidly evolving marketplace, business growth demands more than just vision and ambition. It requires solid financial foundations, strategic decision-making, and insightful planning. This is where accountants become indispensable allies. Far...

Top Tax-Saving Strategies for Small Businesses in Ontario

Introduction Effective tax planning is essential for the financial health of any small business, especially in a competitive and regulated environment like Ontario. Strategic decisions made throughout the year can reduce your tax burden and improve profitability. At...

Why Accurate Payroll Management Is Critical for Business Success

Payroll is more than just paying employees on time—it’s a cornerstone of business operations. When managed correctly, it ensures regulatory compliance, builds employee trust, and contributes to your overall financial stability. However, inaccurate payroll can result...

How Professional Accounting Services Save Your Business Time and Money

In today’s fast-paced business environment, time and money are two resources you simply can’t afford to waste. Whether you're a startup founder, a seasoned entrepreneur, or a growing small business in the Greater Toronto Area, managing your finances efficiently is...

Incorporated vs. Sole Proprietor: Which Is Better for Tax Savings?

Introduction Choosing the right business structure is one of the most important financial decisions entrepreneurs in Canada face. Whether you operate as a sole proprietor or choose to incorporate your business can significantly impact your tax burden, liability, and...

How to Maximize Tax Returns Using Professional Services

When tax season arrives, everyone’s goal is the same: maximize their refund or minimize their liability. However, navigating Canada's complex tax system can be challenging without expert guidance. For individuals and businesses in the Greater Toronto Area, partnering...

Newsletter

Get Notified Of New Listings & Homeowner Tips

Divi Real Estate

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour

Contact

(923)-234-6788

Offices

4254 Divi St. San Francisco, CA

2354 Extra Blvd. San Jose, CA